maricopa county tax lien map

Auction properties are updated daily on Parcel Fair to remove redeemed properties. 7 watchers 7 watchers.

Phoenix Metro Light Rail Extension Plans System Map Light Rail Arizona Travel

The largest county in Arizona Maricopa County is home to the city of Phoenix and surrounding cities like Mesa Chandler and Glendale.

. The average yearly property tax paid by Maricopa County residents amounts to about 206 of their yearly income. Seller 100 positive Seller 100 positive Seller 100 positive. 3 bids 3 bids 3 bids shipping shipping shipping.

Pursuant to ARS 42-18106 a listing of each parcel showing the parcel number delinquent tax amount the property owners name and the propertys legal descriptionIn addition each listing includes the Assessors full cash value of the land improvements and any personal property associated. Like Maricopa County in Arizona Broward County in Florida and Denver County in Colorado are holding their tax lien sales on the Internet rather than at the courthouse making travel expenses and time away from home a thing of the past. Map of Parcels with Overdue Taxes.

You can use the Arizona property tax map to the left to compare Maricopa Countys property tax to other counties in Arizona. The average effective tax rate in the county is just 061. Arkansas 2022 Tax Auctions.

We accept major credit card and debit card payments over the telephone. To pay by telephone call toll-free 18884730835. Your Secured Property Tax Bill contains your Assessors Identification.

PRE-FORECLOSURE FLORIDA TAX LIEN CERTIFICATE FOR LAND 023 ACRES PUNTA GORDAFL. Home In Phoenix Arizona Metro Area Maricopa County Pre-Foreclosure Tax Lien 10000. Home In Phoenix Arizona Metro Area Maricopa County Pre-Foreclosure Tax Lien 10250.

Property tax rates in Pima County are the second highest of any county. Assessing accuracy and. The purpose of the Recorder of Deeds is to ensure the accuracy of Maricopa County property and land records and to preserve their continuity.

Rates vary by city and school district though. Maricopa County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Maricopa County Arizona. We have tried to ensure that the information contained in this electronic document is accurate.

Delinquent and Unsold Parcels. 9 Arizona counties have now released their 2022 Tax Lien auction properties. 1 bid 1 bid 1 bid shipping shipping shipping.

Certain types of Tax Records are available to the. These records can include Maricopa County property tax assessments and assessment challenges appraisals and income taxes. The Maricopa County Recorders Office presents the information on this web site as a service to the public.

The place date and time of the tax lien sale. 2 bids 2 bids 2 bids shipping shipping shipping. You can now map search browse tax liens in the Apache Cochise Coconino Maricopa Mohave Navajo Pima Pinal and Yavapai 2022 tax auctions.

The Maricopa County Recorder of Deeds located in Phoenix Arizona is a centralized office where public records are recorded indexed and stored in Maricopa County AZ. Maricopa County Treasurers Home Page. We would like to show you a description here but the site wont allow us.

LOS ANGELES COUNTY TAX COLLECTOR KENNETH HAHN HALL OF ADMINISTRATION 225 NORTH HILL STREET ROOM 137 LOS ANGELES CA 90012. Maricopa County is ranked 1363rd of the 3143 counties for property taxes as a percentage of median income. Arizona Tax Auctions Jan 17 2022.

You can use the Texas property tax map to the left to compare Comal Countys property tax to other counties in Texas. In certain municipalities the treasurers office will eventually place a property tax lien on the property. This lien is a public claim for the outstanding delinquent tax meaning the property cannot be transferred or sold.

PRE-FORECLOSURE FLORIDA TAX LIEN CERTIFICATE FOR LAND 023 ACRES PUNTA GORDAFL. 11 watchers 11 watchers 11 watchers. The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and accountability of their.

2 bids 2 bids 2 bids shipping shipping shipping. The Recorders Office makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link. Learn how to purchase Tax Lien Certificates from the comfort of your home and SAFELY earn 16 to 240.

King County collects the highest property tax in Texas levying an average of 506600 156 of median home value yearly in property taxes while Terrell County has the lowest property tax in the state collecting an average tax of 28500 067 of median home. If payments are not made to the county treasurer in a timely manner they become delinquent incurring interest and fees each month they remain unpaid.

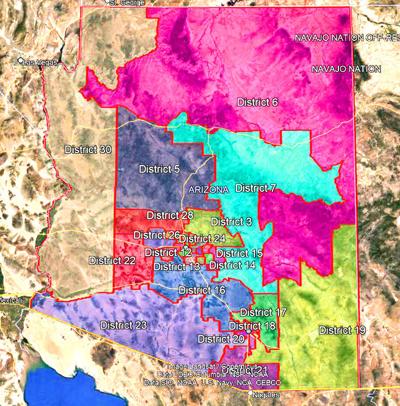

Redistricting Committee Seeks To Merge Gop Legislative Parts Of Pinal With Tucson Area Area News Pinalcentral Com

Maricopa County Zip Code Map Area Rate Map Metro Map Zip Code Map Map

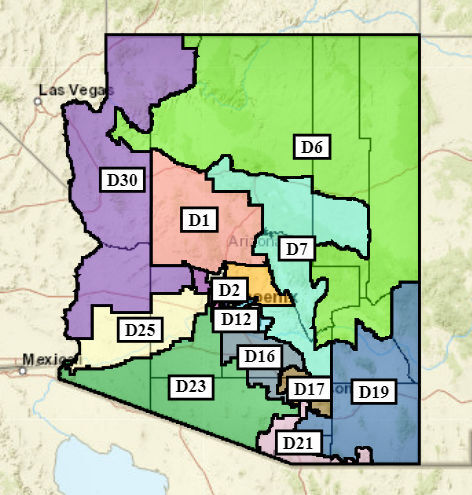

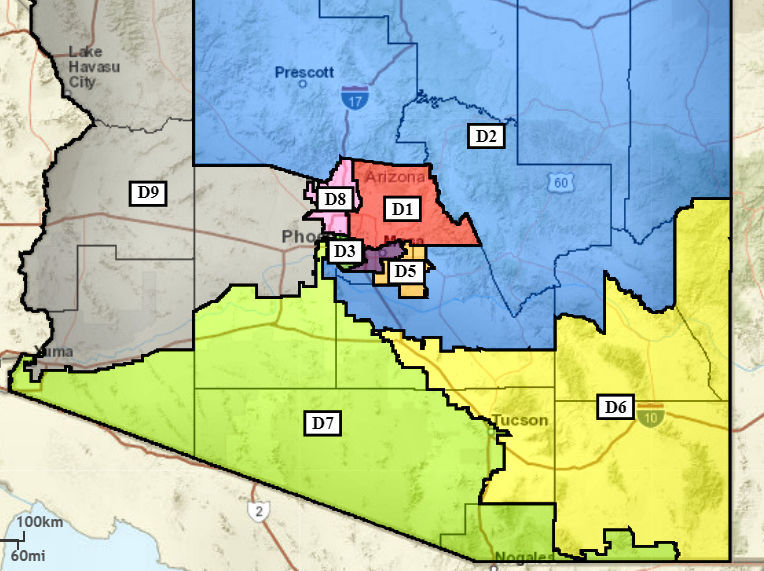

Cg Mayor Says New District Map Unlikely To Hurt Major Regional Goals Area News Pinalcentral Com

Cg Mayor Says New District Map Unlikely To Hurt Major Regional Goals Area News Pinalcentral Com

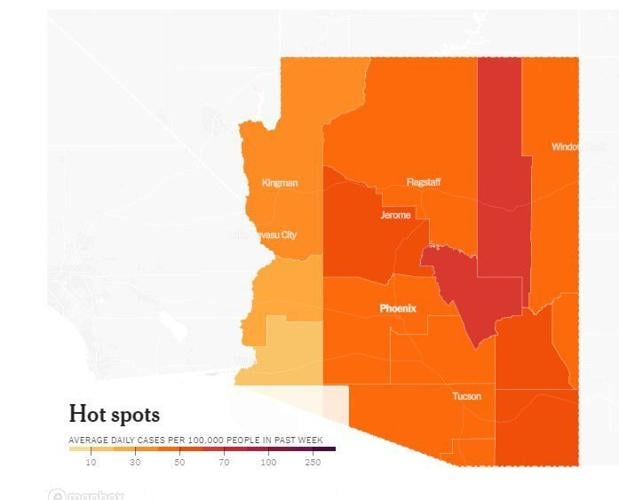

Redistricting Committee Seeks To Merge Gop Legislative Parts Of Pinal With Tucson Area Area News Pinalcentral Com

6301 N Mountain Spring Ln Hackberry Az 86411 Realtor Com